Hello, and thank you for joining me. My name is Fernando Zoota and I am your host for the podcast and blog, Non-QM Insider, the show where we talk about regulations, guidelines, and anything having to do with non-qualified mortgages. Today we will be discussing non-QM loan volume or the lack of it. Let’s get into it.

The most discussed topic of conversation in non-QM circles has to do with volume. How many non-QM loans are floating around in the ether? Lenders are offering bank statements and DSCR loans, but what does that mean? Did the industry flip the switch on and expect the machine to start churning out loans? Unfortunately, I believe that’s exactly what’s happened and now that the loan Genie hasn’t delivered, we’re in the midst of a head-scratching moment.

Volume-wise, we’ve taken a 3-year step backward.

I’ll get into how I know that in a moment. Unlike 2017, in 2020 we have historical data to review. So, let’s take a look at the numbers.

As of the time this article was written, the average interest rate on a 30-year fixed is 3.500%. According to S&P Global, interest rates are expected to increase by 20 – 30 BPS by the end of 2020. So what? Rates will be 3.800% by the end of the year. Big whoop, that’s not enough of a rate increase to drive non-QM volume. According to S&P Global, in 2017 non-QM issuance was approximately $4B. Skip ahead 2 years and the non-QM issuance in 2019 was $25B. Additionally, S&P Global projects an issuance of approximately $6B for 2020.

That’s an $18.5B drop in volume, year over year.

Using an average loan amount of $354,500 (provided by Reuters) and dividing it by $18.5B, I’ve calculated there are roughly 52,000 fewer loans in 2020 than in 2019. That’s a stark reality. So now what? Do we throw in the towel and look for a new job? Not quite.

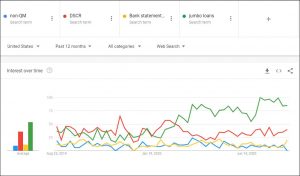

As I said, we have a lot more data available to us in 2020 than we did in 2016 & 2017. One thing we know is that Jumbo loans have been a significant part of non-agency RMBS. According to S&P Global, in 2019 jumbo loans accounted for approximately $23B of non-agency issuance. That amount has dropped (post-COVID) because the big banks are no longer able to sell jumbos in the secondary market. However, depending on their relationships, many non-QM lenders still have jumbo loan options available. Additionally, there’s historical data on the performances of jumbo loans, prior to and through the pandemic. Search data show a huge jumbo loan demand by the public, far more than searches for DSCR, bank statements for income, or non-QM in general.

Non-QM lenders typically offer loan amounts from $100K – $3M. Jumbo loan limits are non-applicable. Big banks have throttled down jumbo loan origination’s and demand is high from the public. Seems like a no brainier non-QM to me. Lenders offering a legitimate, competitively priced jumbo loan program will acquire more of the non-agency market. Conversely, non-QM lenders without a jumbo program is like a horse sitting at the gate while the rest of the pack is rounding the first lap.

Do you agree or disagree? Comment down below.